scroll

How quality, transparency and oversight can restore confidence and channel capital where it’s needed most.

The promise of carbon markets has always been bold: to provide companies and countries with a credible mechanism to offset emissions as they work toward long-term decarbonization. At the same time, they channel private capital into projects that accelerate climate action—particularly in the Global South, where resources are most urgently needed.

At their best, these markets address residual emissions today while financing renewable energy, conservation, regenerative agriculture, and durable removals that deliver lasting climate impact.

In recent years, however, headlines have focused more on problems than promise. Accusations of greenwashing, questions about integrity, and declining confidence from both buyers and the public have slowed voluntary market transactions. Trust is the foundation of effective carbon markets. Without it, capital dries up and climate momentum stalls. Yet trust is being rebuilt. Across the ecosystem, from project developers to regulators, new commitments to quality, transparency, and independent oversight are reshaping the market and raising expectations.

Skepticism did not emerge in a vacuum. Early offset projects often promised more than they delivered. Some overstated their climate impact, others failed to ensure permanence, and many lacked robust monitoring. Global standards were fragmented, buyers had little clarity on what distinguished a “high-quality” credit, and public understanding lagged far behind the technical nuances.

Historically most credits were avoidance or reductions— projects that prevented emissions that might otherwise have occurred — rather than projects that actively removed carbon from the atmosphere. Roughly 75% of all certified credits available are avoidance credits. Because these credits depend on counterfactual scenarios (“what would have happened without the project”), they are more vulnerable to over-crediting or weak baselines.

The reliance on avoidance credits fueled perceptions that offsets were not delivering real, durable climate impact. As scrutiny increased, the market saw cooling corporate enthusiasm, accusations of greenwashing, and louder calls from policymakers for stronger guardrails.

Recently, demand has been shifting. Buyers are increasingly prioritizing carbon removal credits, which pull CO₂ from the atmosphere and store it for extended periods. Purchasers of removals increased their buying fivefold from 2021 to 2023. Even as overall volumes dipped, premiums for high-quality removal credits have held steady, reflecting confidence in their verifiable climate impact.

Carbon markets are technically complex, and that complexity can fuel mistrust. Even the concept of a “carbon credit” can confuse the public. Companies and investors face a maze of methodologies, standards, and project types that are difficult to compare.

This opacity makes it hard to identify quality and creates space for misinterpretation. Even seasoned journalists covering greenwashing allegations sometimes miss important distinctions. Technical rigor alone is not enough—markets also need plain, accessible communication so participants can explain what makes a credit legitimate and why it matters.

At the heart of rebuilding confidence is clarity about what makes a carbon credit credible. Four elements are now broadly recognized:

Additionality: The climate benefit would not have happened without revenue from the credit.

Permanence: The reduction or removal must endure—decades for land use projects, centuries for engineered solutions.

Measurability and verifiability: Data must be robust, methodologies transparent, and results confirmed by independent review.

Co-benefits: Beyond carbon, projects should deliver tangible benefits such as biodiversity protection, water security, job creation, or community resilience.

Both nature-based and engineered solutions bring unique strengths. Forest conservation, soil carbon, and mangrove restoration deliver climate, community, and ecosystem benefits. Direct air capture and mineralization offer unmatched durability. The market is not about one versus the other—it’s about building a diverse portfolio where quality is the common denominator.

Emerging benchmarks help provide that clarity. The Integrity Council for the Voluntary Carbon Market (ICVCM) has issued Core Carbon Principles for supply. The Voluntary Carbon Markets Integrity Initiative (VCMI) provides guidance for buyers. The Carbon Credit Quality Initiative (CCQI) provides comparative scoring of credit types. The Science Based Targets initiative (SBTi) has tightened corporate guidance on use of offsets. These frameworks are still maturing, but corporates are already aligning procurement strategies with them.

Trust requires visibility. Buyers, regulators, and the public need to see how credits are generated, verified, and ultimately retired.

Transparency is improving across the value chain:

Public registries now make it easier to track issuance and retirement.

Digital MRV systems, using satellites, sensors, and AI, are making traceability more precise.

Corporate disclosure is expanding, with more companies publishing procurement principles and audit-ready data.

Increasingly, “radical transparency” is becoming a market differentiator. Developers—whether building large-scale engineered removals or community-based land projects—who open methodologies, publish data, and invite independent scrutiny are rewarded with buyer confidence.

Independent oversight remains the guardrail of trust. Validation and verification bodies (VVBs) conduct audits. Standards such as Verra, Gold Standard, Social Carbon, and Climate Action Reserve enforce methodologies.

Progress is visible. Several standards have accelerated methodology updates in response to critiques, while digital tools are being piloted to make audits faster and more consistent. The Wall Street Journal noted that Verra’s new Project Hub and risk-based review process has already cut registration timelines by 60%, showing how oversight bodies are beginning to adapt. Programs approved under CORSIA are already raising the bar for aviation, and Article 6 implementation is beginning to align voluntary oversight with national accounting. Corporate pioneers like Microsoft, Shopify, and Frontier are de-risking the space with long-term commitments to durable removals and transparent procurement. Governments such as Singapore are creating compliance frameworks that incorporate voluntary credits, providing models others can follow.

These checks are not without pressure. The challenge is scaling oversight capacity without sacrificing rigor. Still, integrity is no longer abstract: markets are beginning to reward quality and channel finance toward solutions that can scale with confidence.

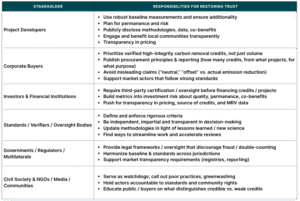

Rebuilding trust is a collective responsibility. Each stakeholder has a role: When each group holds itself accountable, the market as a whole becomes more resilient.

Rebuilding trust is ongoing work. But when a few low-integrity projects cast a shadow over the whole sector—or when ungrounded accusations of greenwashing surface—the fallout often lands on the most vulnerable. One weak project does not mean the entire market is flawed, yet its ripple effects can be severe: buyers retreat, farmers lose income as credit demand drops, restoration efforts stall as funding dries up, and local jobs and ecosystem gains vanish as capital shifts elsewhere.

Maintaining trust in high-quality, third-party verified carbon removal projects is essential to reward the people delivering real climate action and protect the landscapes and communities on the frontlines of change.

The carbon market is at an inflection point. Its original promise was twofold: to provide companies a near-term pathway to manage residual emissions as they decarbonize, and to channel private finance into climate solutions where it is most urgently needed.

Trust will be restored when actions consistently prioritize quality, transparency, and accountability. With trust, carbon markets can scale to gigaton-level impact while strengthening resilience for the communities most vulnerable to climate change. Without it, both climate progress and public confidence are at risk.